Bank Reconciliation Statement

A bank reconciliation statement is a statement drawn up to verify the cash book balance of an organization with the bank statement sent by its bank.

A bank statement is the statement of account as kept by the bank on behalf of its customer for a transaction made by the customer through the bank. It shows lodgment into the account on the credit column and withdrawals on the debit column while the balance in the account is shown after lodgment or withdrawals in the account.

Subscribe to our YouTube channel so as not to miss a tutorial video.

Reasons for Bank Reconciliation

- It affords the opportunity to update the cash book.

- It serves as a means of correcting errors.

- Fraud can be detected and prevented.

- It enables the business to highlight errors committed by the bankers.

Causes of Discrepancy Between the Cash Book and the Bank Statement.

- Unpresented Cheques: These are cheques paid by the business but not yet passed to the bank or presented for payment. This must have been credited to the cash book while no entry is made in the bank account.

- Uncredited Cheques: These are cheques received by the business and debited to its cash book but have not been credited by the bank.

- Credit Transfer: This is money received by the bank directly from the payer on behalf of the bank customer which is credited to his bank account but is not reflected in the cash book yet.

- Standing Order: This is a written instruction to a bank by a customer who makes regular payments of a fixed sum of his account to a named payee. This is debited by the bank but no entry is made yet in the cash book of the customer.

- Bank Charges: This is the amount due to the bank for rendering service on behalf of a customer with a current account.

- Dishonored Cheque: This is a cheque not honored by the receiving bank due to some defects. A dishonored cheque is usually returned to the drawer for cash payment.

A cheque may be dishonored for the following reasons;

- When there are insufficient funds in the account to pay the cheque.

- When there is an irregular signature or no signature at all.

- When the amount in figures and in words on the cheque are not the same.

- When no date is shown on the cheque or is postdated.

- When there are alterations on the cheque and it is not endorsed by the drawer.

Procedures for Reconciling the Cash Book with the Bank Statement.

- Remember that the debit entries in the cash book are credit entries in the bank statement while credit entries in the cash book are debit entries in the bank statement.

- Ensure that the posting of the cash, as well as the bank statement, is done correctly.

- Tick the debit entries in the cash book to the debit side in the bank statement to identify outstanding items.

- Check the credit side of the cash book to identify unticked items, any item not ticked on this side is referred to as unpresented cheque.

- Check the debit side of the cash book for unticked items, any item not ticked on this side is referred to as uncredited cheque.

- Check the credit side of the bank statement for unticked items, any item not ticked on this side could either be a credit transfer or dishonored cheque. Both items have to be debited to the cash book to update the cash book.

- Check the debit side of the bank statement for unticked items, any item not ticked on this side could either be a standing order or bank charges. Both items must be credited to the cash book to update the cash book.

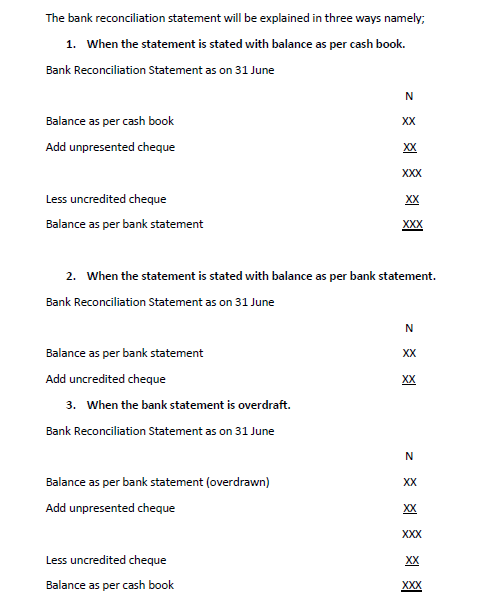

Accounting Procedures for Bank Reconciliation Statement.

Most examination questions will require the candidate to…

- Bring the cash book up to date.

- Prepare an adjustment cash book.

- Prepare a bank reconciliation statement.

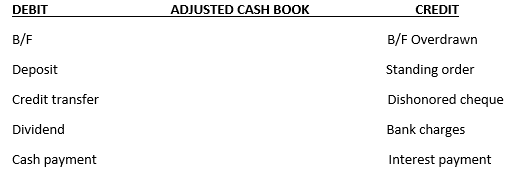

The Adjusted cash book preparation involves starting a new cash book with the current balance carried down in the cash book and write back all items unpicked on the bank statement.

Bank Statements.

Statements are provided at regular intervals to help customers keep a check on their finances. It is particularly useful where standing orders or direct debits are regularly drawn to the account, or where credit transfers are paid in.

The format for the Adjusted Cash Book.

Video Guide On Bank Reconciliation Statement

[wonderplugin_video iframe=”https://youtu.be/SWMjR3EeLW0″ videowidth=600 videoheight=400 keepaspectratio=1 videocss=”position:relative;display:block;background-color:#000;overflow:hidden;max-width:100%;margin:0 auto;” playbutton=”https://hstutorial.com/wp-content/plugins/wonderplugin-video-embed/engine/playvideo-64-64-0.png”]